Want to take your real estate investments to the next level? Knowledge of real estate market cycles informs you on the decisions you can make to optimize your returns.

When learning about market cycles, you know the ideal time to buy, sell, or hold property. Better still, get insights on possible pitfalls and opportunities to avoid.

Market cycles determine the property's value and the investment results. Know when to enter and when to exit.

This blog post highlights four tips to enhance your understanding of real estate market cycles.

Let's start reading to gain valuable insights on changing your real estate approach completely. Take your competitive edge and make smarter investment choices.

Let's get started!

Knowing what to do regarding real estate market cycles is more than necessary; it is an absolute key to your success in the long run.

Knowing the patterns in each real estate market phase will empower you to make well-staged decisions that mitigate risk and increase profit.

You envision the possibility of altogether avoiding the pitfalls of buying in at the top of the market or selling in a down market; this is the power of market cycle comprehension.

With a grasp of the cyclical nature of real estate, you can predict where opportunities lie that could pass others by.

You will know when to buy low and sell high while ensuring that investments always work to your advantage. Understanding market cycles is a simple and rewarding exercise.

You can confidently and precisely navigate changing real estate terrains. Do not leave your investments to chance. Understand the art and science behind market cycles and unlock a world of safe, lucrative investments.

Now that we've established how important it is to understand real estate market cycles, let's explore four practical tips to help you navigate and make sense of the different phases.

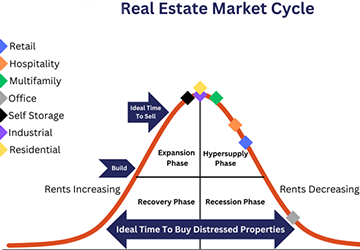

Real estate market cycles have four main stages: Recovery, Expansion, Hypersupply, and Recession.

During the recovery phase, you start noticing the state of stability in the economy and the increasing demand for properties; this usually depicts the perfect time to invest in properties as prices rise.

Since the market entered the Expansion phase, properties' values have increased, and new construction projects have emerged. You have to keep a close eye on the market and stay alert for when it is at the peak of the phase.

The Hyper Supply phase is when an oversupply of properties and weakening demand are seen. During this period, investors must be cautious and prepare for the most likely market correction.

Finally, there is the Recession stage, where property values fall, and investment activity decreases; this is somewhat discouraging but an opportunity for the wise investor who can pick out undervalued opportunities.

Economic indicators are vital to establishing a cycle in the real estate market; measuring these indicators can inform you of many aspects of the market.

Another macroeconomic factor is interest rates – low rates can stimulate investment, making borrowing more attractive, while high rates can squash market activity.

The rate of employment will also directly affect real estate. A high rate of jobs improves the likelihood of a high demand for houses since many people can buy them because of the financial stability of their careers.

The other factor that comes into play is GDP growth. A growing economy should relate to an excellent real estate market since the businesses are growing, and the people have more disposable money.

You must understand the cycles of real estate markets since an imbalance in any of the dynamics tells of market cycles in different phases.

When demand for properties is high, but supply is low, prices tend to increase, usually during the Repair and Expansion stages.

On the other hand, with low demand and excess properties, prices plunge; this is widespread in the Hypersupply and Recession stages.

Look at housing starts and vacancy rates for a decent read on supply and demand conditions. Housing starts estimating the number of new projects under construction, while the vacancy rate indicates vacant properties.

The importance of keeping up with market reports and trends should be emphasized.

Market analyses from credible sources should be read regularly to guide decision-making.

Industry publications and real estate blogs can provide expert opinions and in-depth discussions of market trends. Analysts' and thought leaders' opinions are essential in keeping people one step ahead of the curve.

Another good way to stay current is to attend real estate seminars and webinars hosted by the gurus. They will share many of their experiences and lessons they learned with you.

Be a knowledgeable investor and alter your plans according to market conditions to invest sufficiently in any phase of the real estate cycle.

Learn how to make successful investments by understanding the ups and downs of the real estate market. Take advantage of this chance to take charge of your financial future.

Thousands of investors have already used this insight to make intelligent, profitable decisions.

By understanding markets' cycles, you can stay one step ahead of your competitors and capture opportunities that others will overlook.

Do it today to secure your long-term opportunity in the ever-changing world of real estate. Start your journey to become a successful real estate investor today. Success is within reach!

Q. What are the crucial phases of a real estate market cycle?

Ans. Four key stages constitute a real estate market cycle: recovery, expansion, hyper-supply, and finally, the recession. Each has identifiable features regarding how property values are affected and subsequent investments open.

Q. How do economic indicators impact real estate investment?

Ans. Economic indicators, including changes in interest rates, employment rates and GDP growth, are among the most critical drivers of housing market cycles. Wise decisions come from being able to track these indicators to correspond with economic conditions carefully.

Q. Where can I find reliable market reports and analyses?

Ans. It will mostly be in industry publications, real estate blogs, and reputable research firms, and the market reports and analysis will be equally reliable. Information on real estate seminars or webinars to consider attending would also provide good feedback from these field experts.